Monte carlo investment simulation

The PERT distribution for cost and project modeling. In the following concrete example you will model an asset allocation problem where you decide what portion of wealth should be allocated to risk-free investment or high-risk investment at.

Monte Carlo Simulation In R With Focus On Option Pricing By Ojasvin Sood Towards Data Science

The name Monte Carlo simulation comes from the computer simulations performed during the 1930s and 1940s to estimate the probability that the chain reaction needed for an atom bomb to detonate would work successfully.

. Plexigrid announced the release of the Monte Carlo simulation functionality at the CIGRE conference in Paris France on August 29th 2022. This is usually done by help of stochastic asset models. Each time it runs we record the values.

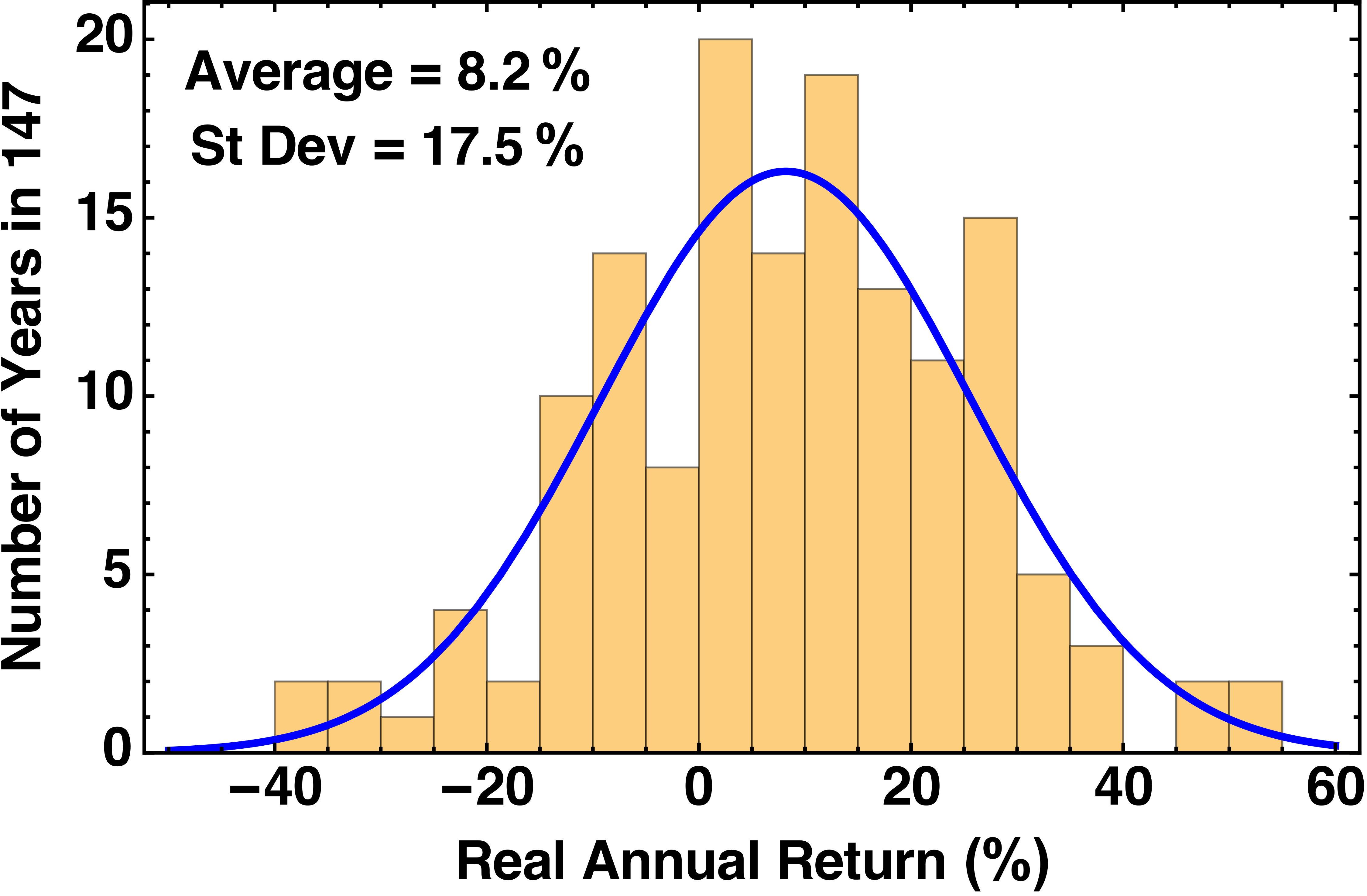

And thats with good reason. What if I want to use an expected annual real stock return of say 35 and an exp. There are two types of risk analysis - quantitative and qualitative risk analysis.

In this way RISK shows you virtually all. We take the number of scenarios where money never runs out in retirement and divide it by 1000 to find the probability of success never running out of money. RiskAMP is a full-featured Monte Carlo Simulation Engine for Microsoft Excel.

Real bond return of -1 using Monte Carlo instead of historical cycles with real returns of 81 and 24 respectively. Monte Carlo methods are used in corporate finance and mathematical finance to value and analyze complex instruments portfolios and investments by simulating the various sources of uncertainty affecting their value and then determining the distribution of their value over the range of resultant outcomes. Industries where simulation and risk analysis are heavily used include.

Monte Carlo simulation explores thousands of possible scenarios and calculates the impact of the uncertain parameters and the decisions we make on outcomes that we care about -- such as profit and loss investment returns environmental results and more. Pouring out a box of coins on a table and then computing the ratio of coins that land heads versus tails is a Monte Carlo method of determining the behavior of repeated coin tosses but it is not a simulation. One situation where Monte Carlo is appropriate is when you need to represent a sequence of decisions that are influenced by outside stochastic risk factors.

The physicists involved in this work were big fans of gambling so they gave the simulations the code name Monte Carlo. Can the net harness a bunch of volunteers to help bring books in the public domain to life through podcasting. Analyze the Profitability of the Investment.

The fastest Monte Carlo simulation in Excel with the ability to handle multiple simulations. This way connection of renewables to the grid. The gamblers fallacy is when an individual erroneously believes that the onset of a certain random event is less likely to happen following an event or a.

This Monte Carlo simulation tool provides a means to test long term expected portfolio growth and portfolio survival based on withdrawals eg testing whether the portfolio can sustain the planned withdrawals required for retirement or by an endowment fund. A Monte Carlo simulation allows analysts and advisors to convert investment chances into choices by factoring in a range of values for various inputs. The Business Intelligence Data Analyst BIDA program will take you on a highly interactive and hands-on journey through the world of data science and business intelligence.

Run the Model with Different. Gamblers FallacyMonte Carlo Fallacy. Monte Carolo simulation is a practical tool used in determining contingency and can facilitate more effective management of cost estimate uncertainties.

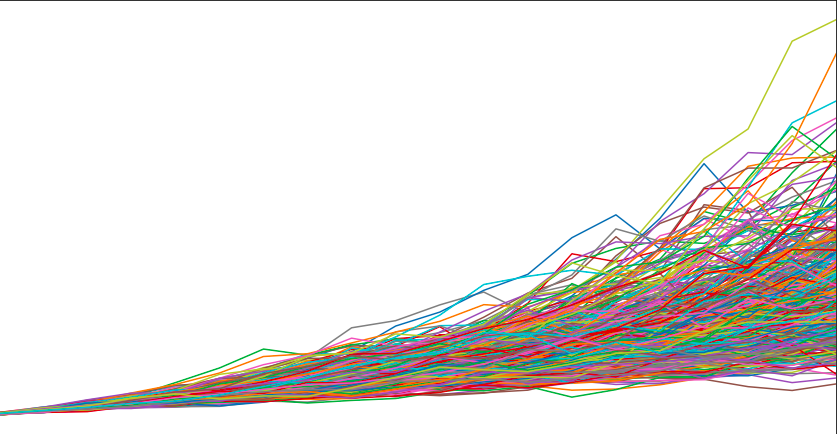

The following simulation models are supported for portfolio. Our Monte Carlo retirement calculator runs 1000 scenarios where the rates of return for every investment changes in each year. Analytic Solver Basic offers 50 distributions and over 30 statistics and risk measures built-in and a distribution Wizard to help you select the right probability distribution fit custom distributions from data and createuse sharable standard DISTs.

It does this using a technique known as Monte Carlo simulation. I notice that you already allow this in your pre-retirement calculator under Monte Carlo simulation which I appreciate. RISKs Monte Carlo analysis computes and tracks many different possible future scenarios in your risk model and shows you the probability of each occurring.

Monte Carlo Simulation also known as the Monte Carlo Method is a computer simulation technique used to estimate the possible outcomes and in the case of a trader estimate a strategys viability. It actually refers to the computer simulation of massive amount of random events. Many who have been exposed to Monte Carlo simulation learned about it in the context of financial modeling such as asset management cash flow analysis or actuarial study.

Drawing a large number of pseudo-random uniform variables from the interval 01 at one. Modeling Risk with Monte Carlo Simulation is a core course of CFIs BIDA program. Monte Carlo simulations are used to model the probability of different outcomes in a process that cannot easily be predicted due to the intervention of random variables.

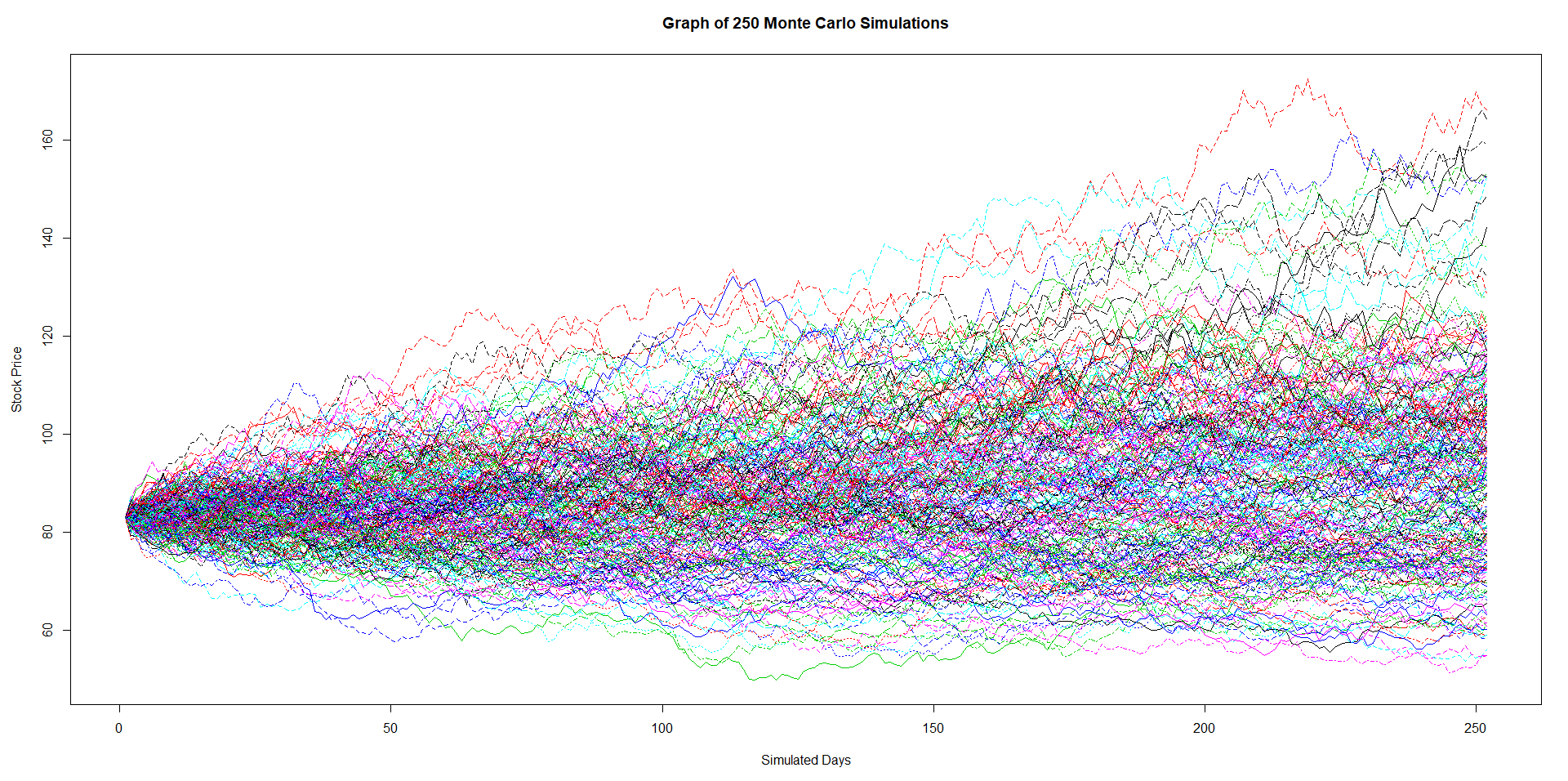

Once we run the monte carlo simulation for several stocks we may want to calculate the probability of our investment having a positive return or 25 return or simply the probability that the. This paper details the process for effectively developing the model for Monte Carlo simulations and reveals some of the intricacies needing special consideration. Indeed the simulation is named after the infamous casino.

An easy-to-use wizard for creating tables and charts. With the RiskAMP Add-in you can add Risk Analysis to your spreadsheet models quickly easily and for a fraction of the price of competing packages. The goal of our Monte Carlo tool is to help illustrate and predict the variability of your trading returns with confidence.

Monte Carlo my first thought on these two words is the grand casino where you meet Famke Janssen in tuxedo and introduce yourself Bond James Bond. LibriVox is a hope an experiment and a question. This paper begins with a discussion on the.

The applications of Monte Carlo simulation for giving valuable insights into areas of financial uncertainty are limitless. The Monte Carlo method has often been used in investment and retirement planning to project the likelihood of achieving financial or retirement goals and whether a retiree will have enough income. How Does Monte Carlo Simulation Work.

Grid planning becomes more efficient and investment decisions more accurate if you can model your network and use the Monte Carlo probabilistic approach. When the simulation is complete we can look at statistics from the simulation to understand the risk in the model. It is a technique used to.

In a Monte Carlo analysis we run the same model selecting a random value for each task but we do it hundreds or thousands of times. The Monte Carlo Simulation method is ideal in performing risk analysis Risk Analysis Risk analysis refers to the process of identifying measuring and mitigating the uncertainties involved in a project investment or business.

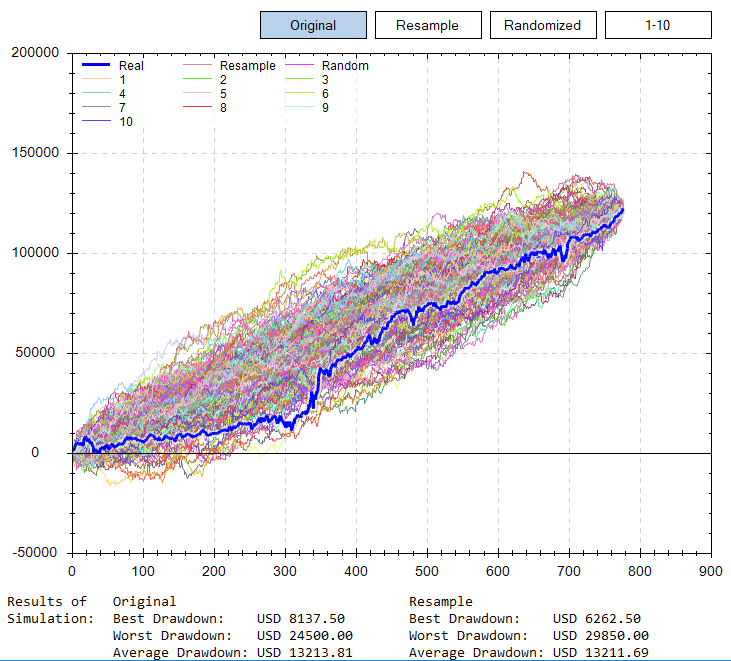

Out Of Sample Testing Using Monte Carlo Simulations Tradingtact

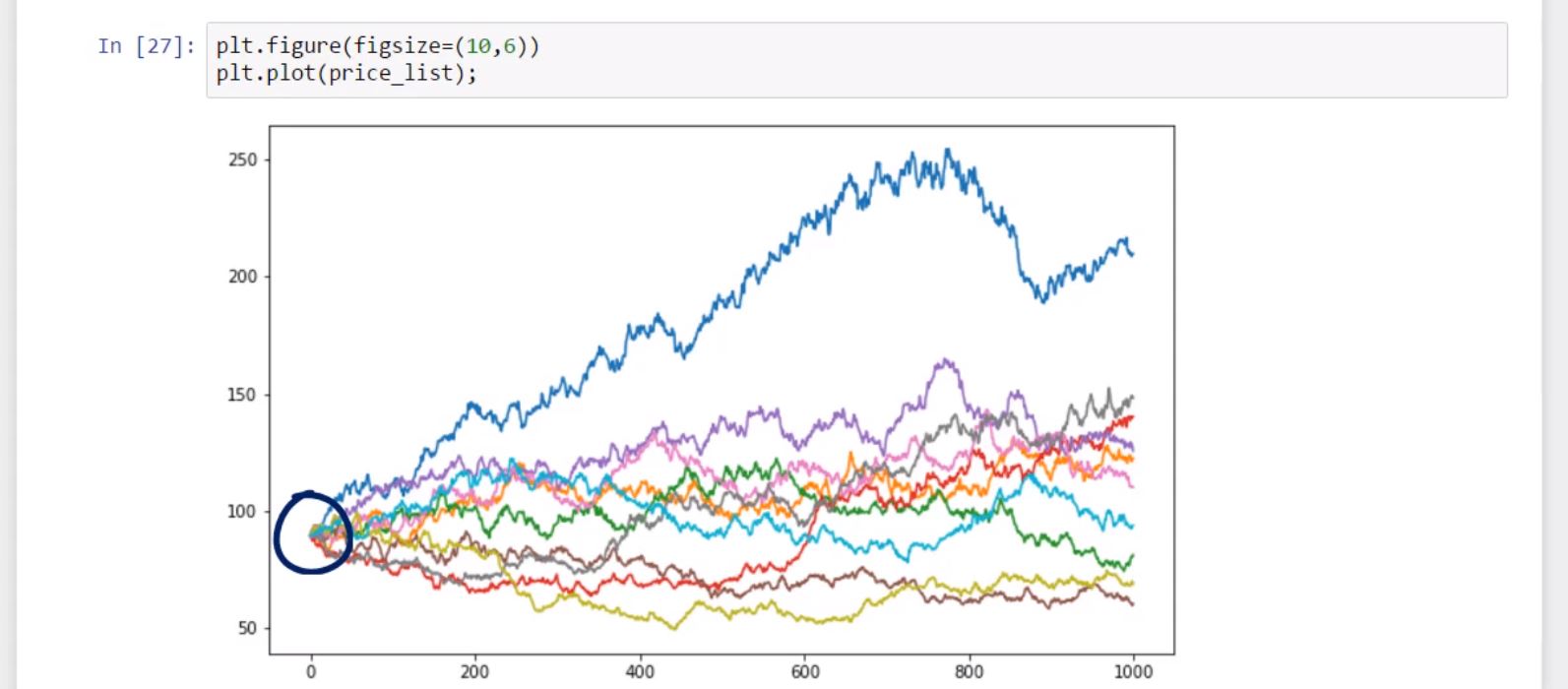

Estimation Of Portfolio Sip Return Using Monte Carlo Python By Aadhunik Sharma Medium

What Good Are Monte Carlo Simulations Anyway Seeking Alpha

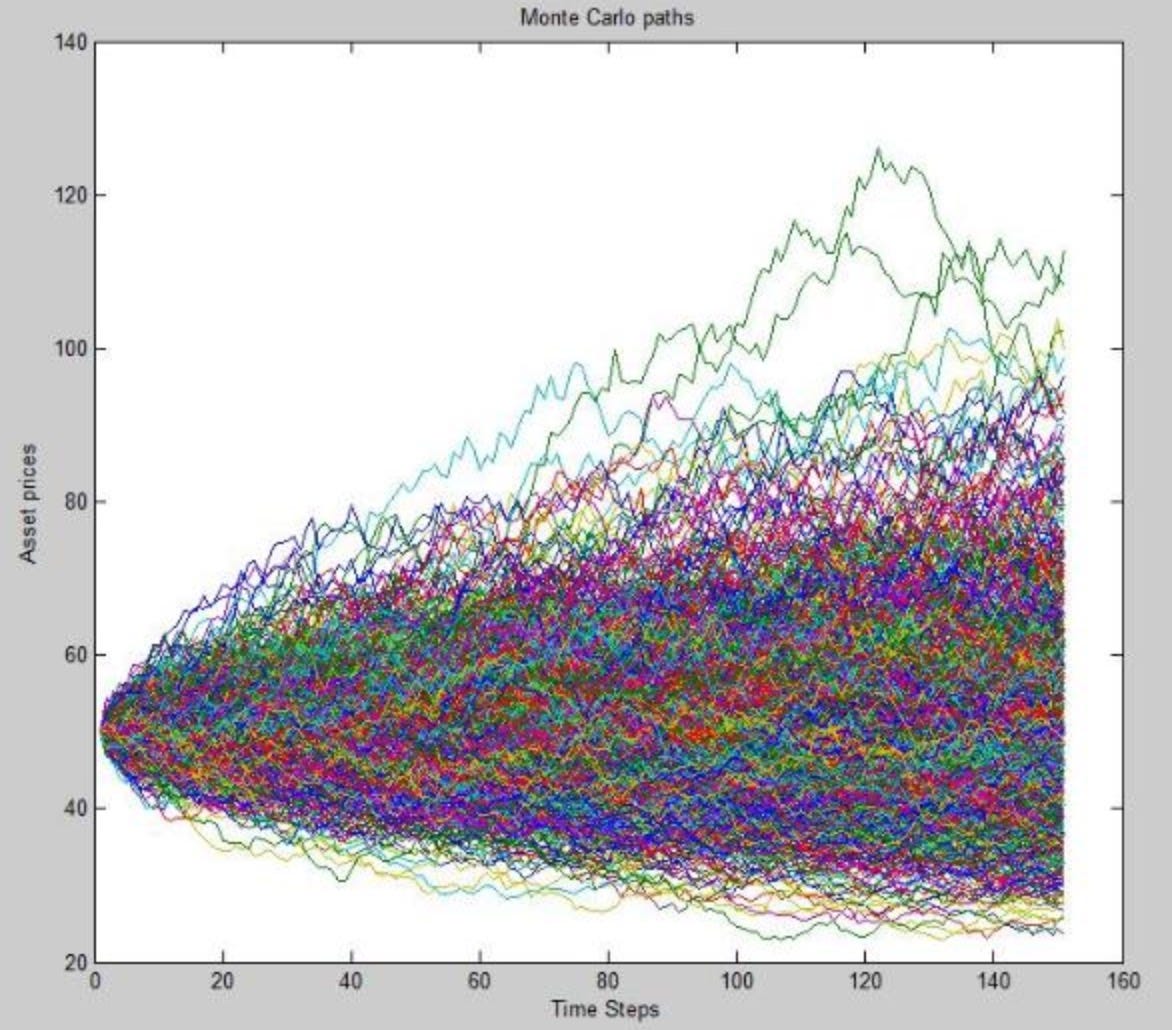

Monte Carlo Simulation Of Stock Price Movement Youtube

Stock Price Simulation Using Monte Carlo Methods Alteryx Community

A Random Walk Model Suggests Investment In Eli Lilly Isn T So Random Nyse Lly Seeking Alpha

3 Of Many Uses For Monte Carlo Simulations In Trading See It Market

Monte Carlo Simulation Advanced Investing Equities Lab

Why Monte Carlo Simulations Can Be Misleading Twp Financial

A 20 Day Monte Carlo Simulation For Stock Price Prediction The Example Download Scientific Diagram

A 20 Day Monte Carlo Simulation For Stock Price Prediction The Example Download Scientific Diagram

An Overview Of Monte Carlo Methods By Christopher Pease Towards Data Science

Monte Carlo Simulation Excel With Marketxls

How To Apply Monte Carlo Simulation To Forecast Stock Prices Using Python Datascience

Simple Monte Carlo Simulation Of Stock Prices With Python Youtube

Monte Carlo Simulation Models Financetrainingcourse Com

Using Monte Carlo Simulations To Settle Equitable Distribution Mycollaborativeteam Com